5 things to watch in Bitcoin this week as greed and leverage get ‘flushed out’

Bitcoin begins the new week above $50,000 after a relatively boring weekend.

Bitcoin (BTC) is keeping bulls and bears guessing as it opens a new weekly candle in the green, heading away from $50,000.

After an uneventful but uninspiring weekend, BTC/USD has begun Monday by reclaiming $53,000 for the first time since Thursday. What could lie in store?

Cointelegraph takes a look at five factors that could shape BTC price action in the coming days.

BTC/USD 1-week candle chart (Bitstamp). Source: TradingView

Stocks steady but dollar dives

Stocks are once again cool this week as the macro picture presents a familiar mixture of hope and misery driven by the coronavirus.

While Asian markets had an uneventful day on the whole, India’s virus problems and Turkey’s financial woes were cause for concern.

Separately, with the United States set to send tourists to the European Union this summer, fresh economic incentives for traders are beginning to take shape.

With no overall direction, however, the impetus for Bitcoin to track a macro narrative is barely existent — and the day’s price movements are already proving it.

“What does the future hodl?” Tesla and SpaceX “Technoking” Elon Musk summarized on Saturday in a tweet that will be poignant for many a market participant. Tesla, one of the big-name BTC investors, is due to report on earnings after the Wall Street close.

When it comes to the dollar, the opportunity for Bitcoin is more skewed to the upside — the U.S. dollar currency index (DXY) is continuing its decline after closing below 91 on Friday. As Cointelegraph often reports, the index, particularly over the past year, tends to be negatively correlated with BTC/USD.

BTC regains $53,000 mark

Bitcoin spot price action is already offering surprises, and unlike last week, it’s the bears who are being caught unaware.

Data from Cointelegraph Markets Pro and TradingView reveals BTC/USD rising to hit $53,000 for the first time since losing the same level on its way down last week.

The level itself is significant, equalling a Bitcoin market cap of $1 trillion and thus previously forming a line in the sand that analysts thought would hold.

In the event, it was $46,000 that provided the floor, but as yet, there is no firm belief that the latest price dip is over. This is evidenced in trading positions, as the move up to $53,000 liquidated shorts to the tune of $150 million in an hour.

“Looks like this interim sell-off might be reaching its conclusion,” podcast host Preston Pysh suspected late on Sunday.

The scope of the dip was a shock to some investors, coming despite hordes of new buyers entering the network. On-chain metrics as a whole have remained in the green, lending further weight to the theory that current circumstances are a temporary blip in an otherwise enduring bull market.

“Market is very emotional over 2%+/- Swings on closes,” Filbfilb, co-founder of trading suite DecenTrader, told Telegram subscribers last week.

“Take note, volatility will be inbound soon. I’m quite bullish but think we need a bit more of a shake before up. Could be wrong… about the direction, but not so much about the volatility so buckle up.”

Difficulty set for biggest retrace since November

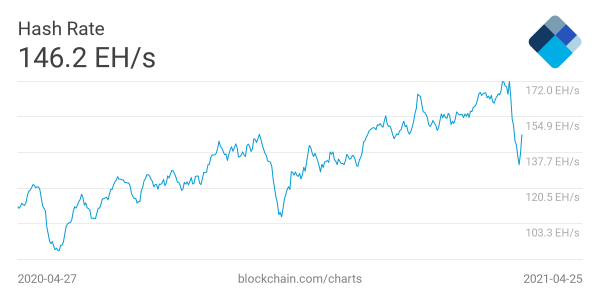

In fundamentals, miners continue to recover from a Chinese power outage that truncated the network’s hash rate overnight earlier in April.

As a result of flooding, as before in Bitcoin’s life, large segments of China’s mining power disappeared from the network, leading to a drop in hash rate, which at one point neared 25% of all-time highs.

Since then, miners have begun adapting, while a drop in mining difficulty will allow smaller operators to mine more profitably and provide an incentive for maintaining network security.

This drop, set to occur in around five days’ time, will be the largest negative move since Nov. 3, when BTC/USD was still at $13,000.

7-day average Bitcoin hash rate. Source: Blockchain.com

Difficulty adjustments form an essential, if not the most essential, part of Bitcoin’s ability to maintain itself regardless of external factors influencing its modus operandi.

Recent months have been characterized by upticks in difficulty, which together with the hash rate has seen consistent new all-time highs. Should history continue to repeat itself, price action should also revert to gains in line with their recovery.

Commenting on recent events, Adam Back, CEO of Blockstream, cautioned observers on their choice of statistics resource and argued that the drop had not in fact been as large as some suggested.

“Bitcoin hashrate back at 157 EH about 5% below 168 EH peak. Mostly recovered from 25% down at 125 EH,” he tweeted on Sunday.

Sentiment tends toward “extreme fear”

Along with shorts and overleveraged longs alike, it seems that irrational sentiment in crypto has finally been shaken out.

That’s the conclusion of the popular Crypto Fear & Greed Index, which uses a basket of factors to determine trader sentiment and, therefore, what’s likely to occur on BTC/USD as a result of their actions.

Previously, as new all-time highs of $65,000 appeared, Fear & Greed was nearing historic record highs in line with the tops of bull markets past.

At nearly 80/100, a sell-off was clearly on the cards as per the metric, which took around a week to react to the price dip down to $46,000.

Now, however, the pressure is off, and the index has gone from “extreme greed” to “fear” — effectively a “reset” of sentiment, which provides scope for further price gains.

Analyst highlights price dip “silver lining”

It’s not just private individuals who have undergone a serious mood change. According to other metrics, erratic behavior from professional traders has also been effectively cleansed from the market.

In his latest update for Morgan Creek Digital co-founder Anthony Pompliano’s market newsletter on Friday, analyst William Clemente noted that longs had once again become an attractive bet.

“There was some silver lining to this event, greed and leverage was flushed out,” he wrote.

“In addition to the liquidations, this can be illustrated by funding rates. To peg the perpetual swap contract to Bitcoin spot price, funding rates are used. When the majority of traders go long, it becomes profitable to go short, and vice versa. During the event, funding rates flipped negative, meaning it became profitable for traders to take the long side of the trade. This has shown to be a buy signal in the previous two times this happened during this bull market.”

Also approaching a “full reset” is the spent output profit ratio (SOPR), a metric, which Cointelegraph previously noted, tends to dictate local market bottoms.

“Currently, SOPR is approaching the full reset mark, meaning price has either reached, or is very closing to reaching, the bottom of the current correction,” Clemente added.

Source: cointelegraph.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Stellar

Stellar  Sui

Sui  Hedera

Hedera  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  WETH

WETH  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Bitget Token

Bitget Token  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  USDS

USDS  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Monero

Monero  Render

Render  Cronos

Cronos  Algorand

Algorand  Bittensor

Bittensor  Mantle

Mantle  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Filecoin

Filecoin  Arbitrum

Arbitrum  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Ethena

Ethena  Tokenize Xchange

Tokenize Xchange  Optimism

Optimism  Gate

Gate  Celestia

Celestia  Bonk

Bonk  Stacks

Stacks  Theta Network

Theta Network  Injective

Injective  Immutable

Immutable  Sonic (prev. FTM)

Sonic (prev. FTM)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  Worldcoin

Worldcoin  Binance-Peg WETH

Binance-Peg WETH  Ondo

Ondo  Movement

Movement  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Lombard Staked BTC

Lombard Staked BTC  Binance Staked SOL

Binance Staked SOL  Raydium

Raydium  FLOKI

FLOKI  Rocket Pool ETH

Rocket Pool ETH  Lido DAO

Lido DAO  JasmyCoin

JasmyCoin  GALA

GALA  The Sandbox

The Sandbox  Mantle Staked Ether

Mantle Staked Ether  Kaia

Kaia  Usual USD

Usual USD  Jupiter

Jupiter  Tezos

Tezos  KuCoin

KuCoin  THORChain

THORChain  IOTA

IOTA  NEXO

NEXO  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Beam

Beam  SPX6900

SPX6900  sUSDS

sUSDS  Maker

Maker  Curve DAO

Curve DAO  Pyth Network

Pyth Network  Brett

Brett  Flow

Flow  Marinade Staked SOL

Marinade Staked SOL  Ethereum Name Service

Ethereum Name Service  NEO

NEO  AIOZ Network

AIOZ Network  BitTorrent

BitTorrent  Fartcoin

Fartcoin  Arweave

Arweave  Bitcoin SV

Bitcoin SV  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Official Trump

Official Trump  ai16z

ai16z  Starknet

Starknet  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Renzo Restaked ETH

Renzo Restaked ETH  Decentraland

Decentraland  dYdX

dYdX  Aerodrome Finance

Aerodrome Finance  DeXe

DeXe  Core

Core  Polygon

Polygon  Helium

Helium  Jupiter Staked SOL

Jupiter Staked SOL  Wrapped BNB

Wrapped BNB  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Conflux

Conflux  Jito

Jito  Zcash

Zcash  ApeCoin

ApeCoin  Reserve Rights

Reserve Rights  Chiliz

Chiliz  Akash Network

Akash Network  Eigenlayer

Eigenlayer  Echelon Prime

Echelon Prime  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Compound

Compound  eCash

eCash  Amp

Amp  USDD

USDD  Wormhole

Wormhole  ether.fi Staked ETH

ether.fi Staked ETH  PancakeSwap

PancakeSwap  Mog Coin

Mog Coin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Mina Protocol

Mina Protocol  Mantle Restaked ETH

Mantle Restaked ETH  Pendle

Pendle  Popcat

Popcat  Ronin

Ronin  Gigachad

Gigachad  ZKsync

ZKsync  Ether.fi Staked BTC

Ether.fi Staked BTC  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  DeepBook

DeepBook  Gnosis

Gnosis  Notcoin

Notcoin  dYdX

dYdX  Axelar

Axelar  usdx.money USDX

usdx.money USDX  Grass

Grass  aixbt by Virtuals

aixbt by Virtuals  SuperVerse

SuperVerse  Turbo

Turbo  Bio Protocol

Bio Protocol  cat in a dogs world

cat in a dogs world  Dog (Bitcoin)

Dog (Bitcoin)  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Terra Luna Classic

Terra Luna Classic  Peanut the Squirrel

Peanut the Squirrel  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Oasis

Oasis  ORDI

ORDI  Beldex

Beldex  pumpBTC

pumpBTC  Resolv USR

Resolv USR  1inch

1inch  LayerZero

LayerZero  Livepeer

Livepeer  Kava

Kava  PAX Gold

PAX Gold  CHEX Token

CHEX Token  Kusama

Kusama  APENFT

APENFT  PayPal USD

PayPal USD  Arkham

Arkham  Dash

Dash  Safe

Safe  Nervos Network

Nervos Network  Trust Wallet

Trust Wallet  Blur

Blur  Telcoin

Telcoin  TrueUSD

TrueUSD  Akuma Inu

Akuma Inu  Baby Doge Coin

Baby Doge Coin  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Holo

Holo  INSURANCE

INSURANCE  Creditcoin

Creditcoin  Theta Fuel

Theta Fuel  io.net

io.net  Astar

Astar  MEOW

MEOW  Freysa AI

Freysa AI  QuantixAI

QuantixAI  Stader ETHx

Stader ETHx  tBTC

tBTC  Ether.fi

Ether.fi  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Swell Ethereum

Swell Ethereum  Super OETH

Super OETH  Bridged USDC (Polygon PoS Bridge)

Bridged USDC (Polygon PoS Bridge)  Horizen

Horizen  Ultima

Ultima  GRIFFAIN

GRIFFAIN  BOOK OF MEME

BOOK OF MEME  AgentFun.AI

AgentFun.AI  JUST

JUST  Aethir

Aethir  Hashnote USYC

Hashnote USYC  WOO

WOO  Onyxcoin

Onyxcoin  Verus

Verus  Golem

Golem  Basic Attention

Basic Attention  Ondo US Dollar Yield

Ondo US Dollar Yield  OriginTrail

OriginTrail  Convex Finance

Convex Finance  Vana

Vana  Liquid Staked ETH

Liquid Staked ETH  Enjin Coin

Enjin Coin  Celo

Celo  Solayer Staked SOL

Solayer Staked SOL  Binance-Peg BUSD

Binance-Peg BUSD  Olympus

Olympus  PAAL AI

PAAL AI  Ankr Network

Ankr Network  GMT

GMT  cWBTC

cWBTC  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Qtum

Qtum  WEMIX

WEMIX  MX

MX  Memecoin

Memecoin  Moca Network

Moca Network  Polygon Bridged WBTC (Polygon POS)

Polygon Bridged WBTC (Polygon POS)  Goatseus Maximus

Goatseus Maximus  SafePal

SafePal  EthereumPoW

EthereumPoW  Siacoin

Siacoin  Gas

Gas  Neiro

Neiro  SwissBorg

SwissBorg  Magic Eden

Magic Eden  Osmosis

Osmosis  Harmony

Harmony  AI Rig Complex

AI Rig Complex  aelf

aelf  Qubic

Qubic  Drift Protocol

Drift Protocol  Clearpool

Clearpool  Polymesh

Polymesh  Aevo

Aevo  Chia

Chia  Kadena

Kadena  Sushi

Sushi  Ravencoin

Ravencoin  Bridged Ether (StarkGate)

Bridged Ether (StarkGate)  SATS (Ordinals)

SATS (Ordinals)  Manta Network

Manta Network  Threshold Network

Threshold Network  Dymension

Dymension  Terra

Terra  Illuvium

Illuvium  MimbleWimbleCoin

MimbleWimbleCoin  Mask Network

Mask Network  L2 Standard Bridged WETH (Blast)

L2 Standard Bridged WETH (Blast)  yearn.finance

yearn.finance  Humans.ai

Humans.ai  would

would  XYO Network

XYO Network  Usual

Usual  Zeus Network

Zeus Network  ChainGPT

ChainGPT  PHALA

PHALA  Metars Genesis

Metars Genesis  CoinEx

CoinEx  SKALE

SKALE  Tribe

Tribe  Wrapped AVAX

Wrapped AVAX  Loopring

Loopring  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Metis

Metis  LCX

LCX  Constellation

Constellation  GMX

GMX  Elixir deUSD

Elixir deUSD  Decred

Decred  Sonic SVM

Sonic SVM  Dogs

Dogs  NEM

NEM  Wrapped Ether (Mantle Bridge)

Wrapped Ether (Mantle Bridge)  Ontology

Ontology  Amnis Aptos

Amnis Aptos  AltLayer

AltLayer  Fluid

Fluid  Galxe

Galxe  UMA

UMA  Sun Token

Sun Token  Nexus Mutual

Nexus Mutual  DigiByte

DigiByte  USDa

USDa  Solana Name Service

Solana Name Service  Treehouse ETH

Treehouse ETH  Apu Apustaja

Apu Apustaja  Hive

Hive  Nosana

Nosana  Avail

Avail  Flux

Flux  Quorium

Quorium  Rocket Pool

Rocket Pool  Band Protocol

Band Protocol  Velo

Velo  aBTC

aBTC  Zerebro

Zerebro  GoldPro

GoldPro  CorgiAI

CorgiAI  Sologenic

Sologenic  0x0.ai: AI Smart Contract

0x0.ai: AI Smart Contract  COTI

COTI  Zano

Zano  Resolv wstUSR

Resolv wstUSR  Hivemapper

Hivemapper  Act I The AI Prophecy

Act I The AI Prophecy  Casper Network

Casper Network  Gravity

Gravity  Solar

Solar  Blast

Blast  Fwog

Fwog  Hamster Kombat

Hamster Kombat  Lorenzo stBTC

Lorenzo stBTC  ConstitutionDAO

ConstitutionDAO  GoMining Token

GoMining Token  UXLINK

UXLINK  Non-Playable Coin

Non-Playable Coin  TARS AI

TARS AI  BTSE Token

BTSE Token  Delysium

Delysium  CoW Protocol

CoW Protocol  cETH

cETH  Zentry

Zentry  MMX

MMX  Unicorn Fart Dust

Unicorn Fart Dust  Audius

Audius  Bitcoin Gold

Bitcoin Gold  Cetus Protocol

Cetus Protocol  Orca

Orca  Rollbit Coin

Rollbit Coin  Ski Mask Dog

Ski Mask Dog  HarryPotterObamaSonic10Inu (ETH)

HarryPotterObamaSonic10Inu (ETH)  Bybit Staked SOL

Bybit Staked SOL  SPACE ID

SPACE ID  Across Protocol

Across Protocol  Nano

Nano  Huobi

Huobi  Balancer

Balancer  Bitkub Coin

Bitkub Coin  SingularityNET

SingularityNET  Wilder World

Wilder World  Liquity

Liquity  Yield Guild Games

Yield Guild Games  Simon's Cat

Simon's Cat  Origin Ether

Origin Ether  Status

Status  Moonwell

Moonwell  Moo Deng

Moo Deng  Mythos

Mythos  Chromia

Chromia  ZIGChain

ZIGChain  Waves

Waves  Big Time

Big Time  ANDY ETH

ANDY ETH  Ava AI

Ava AI  Metaplex

Metaplex  API3

API3  Kamino

Kamino  OUSG

OUSG  Saga

Saga  VVS Finance

VVS Finance  Marlin

Marlin  Supra

Supra  ETHPlus

ETHPlus  OKT Chain

OKT Chain  NetMind Token

NetMind Token  Degen (Base)

Degen (Base)  Hypurr Fun

Hypurr Fun  Fuel Network

Fuel Network  RCGE

RCGE  GHO

GHO  PONKE

PONKE  Centrifuge

Centrifuge  Lisk

Lisk  GAME by Virtuals

GAME by Virtuals  PinLink

PinLink  Spell

Spell  Department Of Government Efficiency

Department Of Government Efficiency  Solv Protocol

Solv Protocol  WAX

WAX  BasedAI

BasedAI  Adventure Gold

Adventure Gold  IQ

IQ  StakeWise Staked ETH

StakeWise Staked ETH  Toshi

Toshi  Oraichain

Oraichain  Open Campus

Open Campus  Venus

Venus  Smooth Love Potion

Smooth Love Potion  Artificial Liquid Intelligence

Artificial Liquid Intelligence  SmarDex

SmarDex  BORA

BORA  iExec RLC

iExec RLC  Ergo

Ergo  IOST

IOST  Ampleforth

Ampleforth  Elixir Staked deUSD

Elixir Staked deUSD  DAO Maker

DAO Maker  Cookie DAO

Cookie DAO  SSV Network

SSV Network  JOE

JOE  Powerledger

Powerledger  Mines of Dalarnia

Mines of Dalarnia  BounceBit

BounceBit  LandWolf

LandWolf  Osaka Protocol

Osaka Protocol  L2 Standard Bridged WETH (Optimism)

L2 Standard Bridged WETH (Optimism)  STP

STP  Songbird

Songbird  Altura

Altura  Ontology Gas

Ontology Gas  Coin98

Coin98  Blox

Blox  Swarms

Swarms  Banana Gun

Banana Gun  Krypton DAO

Krypton DAO  LIMITUS

LIMITUS  NodeAI

NodeAI  Orbs

Orbs  Treasure

Treasure  CARV

CARV  Purr

Purr  Civic

Civic  Anvil

Anvil  Cartesi

Cartesi  Based Pepe

Based Pepe  DevvE

DevvE  Goldfinch

Goldfinch  Dent

Dent  Secret

Secret  NKYC Token

NKYC Token  Redbelly Network

Redbelly Network  Aurora

Aurora  Access Protocol

Access Protocol  dKargo

dKargo