DeFi Project Spotlight: Raydium, Solana’s Top Automated Market Maker

Raydium has quickly become one of Solana’s DeFi blue chips by offering some of the most interesting mechanics in the space.

Key Takeaways

Raydium is a decentralized exchange on Solana that functions unlike any other exchange. It uses liquidity pools but also acts as the biggest market maker on Solana’s order book-based exchange, Serum.

Raydium Explained

Raydium Protocol is Solana’s top automated market maker.

However, it works differently from other decentralized exchanges in that it acts as a market maker for Serum.

To understand why Raydium functions the way it does, it’s worth considering the project’s team. The group had worked together for several years before launching the decentralized exchange in early 2021. The team worked together in a quant trading algorithmic market-making firm on some of the top crypto exchanges.

Raydium’s story has parallels with the story of Sam Bankman-Fried, the billionaire founder of the FTX exchange and Alameda Research and a big supporter of the Solana ecosystem. Both Bankman-Fried and the Raydium team were traders, which shines through in the exchanges they build. Alpha Ray, the founder of Raydium, affirms that Bankman-Fried has been a big help to Raydium. They explain:

“Sam is a big investor in both Solana and Serum, and to make these work he needs a thriving ecosystem on Solana so he’s very helpful. He devotes a lot of his time, and FTX’s resources to help the ecosystem.”

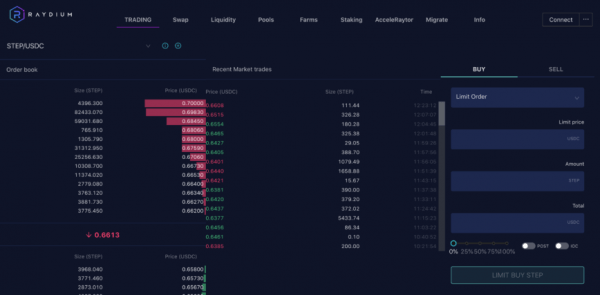

One of the main advantages to centralized exchanges compared to their decentralized counterparts is the ability to create limit orders (although limit orders have been made possible on Uniswap V3 by following a certain technique). Orders need an order book rather than a liquidity pool. Traders prefer to specify the price at which they’d like to trade their assets, which isn’t possible with liquidity pools.

Raydium’s exchange was built on the philosophy of allowing the best of both worlds. When a user enters a trade, it will either be made using Raydium’s own liquidity pools or routed to the decentralized order book Serum depending on where the best price can be found. Alpha Ray explains:

“Serum has an order book system, and Raydium has its own liquidity pools. When users make transactions on our platform, the protocol aggregates liquidity from these two sources, a bit like 1inch on Ethereum.”

Raydium is the biggest market maker on Serum, routing trades from their own users 24/7, making them one of the only DeFi exchanges to have a built-in option for limit orders. The team also has a close relationship with Serum, which means it can quickly troubleshoot any issues that arise.

Raydium is the only DEX that lets users choose between swapping and trading. (Source: Raydium)

Another Raydium team member going by the name Gamma Ray says that Raydium and Serum share their liquidity, which makes the Solana ecosystem more efficient. They explain:

“In DeFi, liquidity is often sioled between different platforms like Sushiswap and Uniswap, which is pretty inefficient. Raydium and Serum seek to share their liquidity with the entire ecosystem. It’s about growing the overall pie for the Solana ecosystem.”

Building on Solana

Solana-based projects like Raydium take advantage of the low cost of using the network. The experience of trading on order books is very different from using liquidity pools. Traders will often enter a limit order, cancel it, modify a few parameters, and reenter. In a decentralized environment, all of these actions are interactions with the blockchain that command a fee.

Solana benefits from low fees—each transaction on Serum costs less than one cent. Similar transactions could set users back $50 a time on Ethereum mainnet. Serum is currently not available on Ethereum, but the emergence of Layer 2 solutions like Arbitrum and Optimism could change that.

Solana’s cheap fees were a key factor behind Raydium’s decision to build on the network. While many DeFi projects started flocking to Ethereum in the summer of 2020, the need for extremely low gas fees forced Raydium to look for alternatives. Solana’s technical prowess managed to convince the team. Speaking of the decision to build on Solana, Alpha Ray says:

“We needed a blockchain with high transaction throughput, high speed, and low fees. When we started building on Solana there wasn’t much there. We were scared that if Solana wasn’t able to build up, it wouldn’t matter how good our platform was. Now, we’re obviously very happy to have taken that risk.”

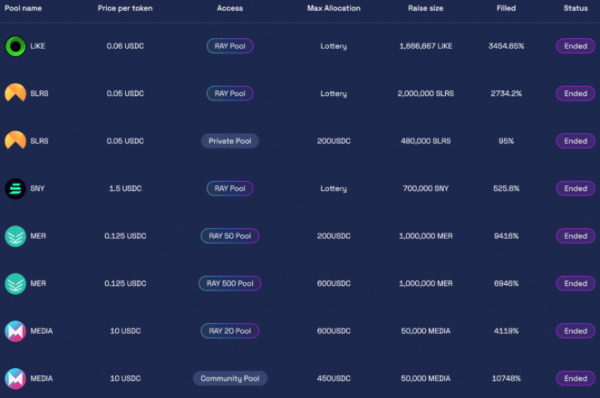

Now, one of Raydium’s key goals is to grow the Solana ecosystem by attracting more projects, talent, and users. For that, the team created AcceleRaytor, a launchpad for new projects that facilitates community investment into new Solana projects.

Raydium’s AcceleRaytor (Source: Raydium)

Many projects on AcceleRaytor are very popular. Most of them had oversubscribed launches, which resulted in random draws between all interested investors to decide who would receive a token allocation. Alpha Ray notes that Raydium identified the need to attract top-quality projects early on. He says:

“For Raydium to be big, we need a lot of tokens to exchange. We need active trading on many solid projects and a thriving ecosystem so that people will move their DeFi business to Solana. We tried to identify what we needed when we launched and give that to these projects. A solid marketing push, sufficient funding, a liquid trading market, and finally a fusion pool that distributes rewards to early investors.”

Raydium meticulously studies any project that goes through AcceleRaytor to introduce strong projects to investors and build a solid relationship built on trust.

NFTs are another big area that Raydium is monitoring, although plans for an NFT marketplace are not a priority. Improving the current product offering is currently Raydium’s main goal. Alpha Ray explains:

“NFTs are huge right now, and they bring a lot of people to Solana as well. This forces users to leave centralized exchanges, and at that point, they try Raydium. NFTs are key to bringing new users to DeFi, and Solana’s lower fees could bring even more people.”

The Risks for Raydium

While Raydium has a promising future, there are some potential risks. The team has identified three key areas that could negatively impact the project: security risks, competition, and dependency on Solana’s ecosystem growth.

In terms of security, the team admits that there’s a possibility that someone could exploit an unforeseen vulnerability in their smart contracts, which is why protocol security is a top priority. Alpha Ray explains:

“Hacks and smart contract exploits in DeFi are happening every day now. It’s just the nature of the industry—something we must come to terms with. When you’ve got open source code custodying millions, there’ll always be someone trying to break it. Every time there’s a novel smart contract exploit in DeFi, we’re going back and reviewing our code to check whether we’re vulnerable to the same attack vector.”

The team isn’t particularly worried about competition. They say it’s “part of the game,” and when you’re the top project in your niche, there’s always someone gunning to take your spot. There’s plenty of room to grow the pie for everyone on Solana, so that’s what the team is focused on. The team says its product line is similar to Sushi, but its approach to growth is closer to Uniswap. In other words, it’s hoping to onboard as many users to the Solana ecosystem as possible without worrying too much about competition.

The only remaining worry is whether Solana succeeds in growing into a thriving, self-sustaining ecosystem, similar to Ethereum today. Every project building on newer or “alternative” smart contract blockchains faces this dilemma, especially when the Layer 1 protocol isn’t compatible with the Ethereum Virtual Machine (Solana was not EVM-compatible when Raydium started building on it, though solutions are emerging). Alpha Ray reveals that the team spent a long time considering which Layer 1 protocol to build on. He says:

“Our biggest worry at the beginning was whether we made the right choice to build on Solana. It was undoubtedly the superior protocol from a technical perspective, but in terms of the ecosystem, there was nothing much on it besides Serum. It was a hard and risky decision to make, but we made it and it now looks like it ended up in our favor.”

The success of Layer 1 protocols is heavily dependent on both network and Lindy effects, meaning the bigger they grow and the longer they survive, the higher the chance that they’ll thrive. While Solana’s success is not guaranteed, the recent ecosystem growth bodes well for Raydium’s future.

The Future for Raydium

Forthcoming plans on Raydium’s roadmap include plans for stableswap pools, which should be out by the end of August. The pools are optimized for minimal slippage, high capital efficiency, and low fees on swaps between tokens with strong price correlations, including stablecoins like USDC-USDT or different synthetics representing the same underlying asset like renBTC-wBTC.

Given that Solana offers low transaction fees, Raydium’s stableswap pools will primarily benefit users in terms of reduced price slippage for large trades using stablecoins or synthetics. The goal is to make Raydium the exchange of choice for small and big traders alike.

After that, Raydium wants to launch its advanced order routing protocol and integrate Wormhole. The order routing protocol will allow users to seamlessly swap between all assets on Solana, regardless of the available pools. For example, if a user wants to trade USDT for FTT but can’t find a pair, Raydium will find the best route between different pools to facilitate the trade at the best price for the swap.

Wormhole, meanwhile, is a decentralized bridge allowing users to port their assets between Solana and Ethereum. For example, it will let users transfer Ethereum-native Uniswap tokens to Solana to benefit from the protocol’s low cost and superior performance. Wormhole will enhance Solana’s interoperability with other blockchains and thus boost the organic growth of its ecosystem.

Raydium also has plans for governance. The team promised to decentralize and roll out governance within six months, but that has proven to be a problem so far. Alpha Ray elaborates:

“Governance has been on our mind, and it’s very important to us, but the issue is Solana currently lacks the proper infrastructure. For example, there’s no gasless DAO voting tool like Snapshot, which is critical for governance. We want to help if anyone wants to build it, but if no one steps up, we’ll have to build it ourselves.”

Raydium is an ambitious project, central to the development of the Solana ecosystem. To date, Solana has few projects that could be classified as “blue chips” that have been central to the ecosystem’s growth. From a technical point of view, Raydium’s hybrid model of trading between order books and liquidity pools is already worthy of attention.

The real kicker lies in its AcceleRaytor feature and in the protocol’s holistic approach to helping projects grow on Solana. Raising money is rarely the biggest challenge for crypto projects—gathering early users is much harder. Raydium’s help in shining the spotlight on worthy projects is one of its most positive contributions to Solana’s DeFi space, and it could help it flourish over the coming years.

Disclaimer Read More Read Less

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: cryptobriefing.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  LEO Token

LEO Token  Pepe

Pepe  Stellar

Stellar  Litecoin

Litecoin  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  Arbitrum

Arbitrum  Filecoin

Filecoin  Mantle

Mantle  OKB

OKB  FLOKI

FLOKI  Cosmos Hub

Cosmos Hub  Aave

Aave  Injective

Injective  Immutable

Immutable  Optimism

Optimism  Celestia

Celestia  The Graph

The Graph  Sei

Sei  Binance-Peg WETH

Binance-Peg WETH  Fantom

Fantom  THORChain

THORChain  Algorand

Algorand  Raydium

Raydium  Rocket Pool ETH

Rocket Pool ETH  Theta Network

Theta Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Brett

Brett  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Mantle Staked Ether

Mantle Staked Ether  Popcat

Popcat  Ethena

Ethena  Bitcoin SV

Bitcoin SV  Pyth Network

Pyth Network  Jupiter

Jupiter  Worldcoin

Worldcoin  Renzo Restaked ETH

Renzo Restaked ETH  Ondo

Ondo  Maker

Maker  Peanut the Squirrel

Peanut the Squirrel  KuCoin

KuCoin  Marinade Staked SOL

Marinade Staked SOL  Quant

Quant  Gate

Gate  BitTorrent

BitTorrent  Arweave

Arweave  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Beam

Beam  Goatseus Maximus

Goatseus Maximus  Flow

Flow  Tezos

Tezos  Polygon

Polygon  Lido DAO

Lido DAO  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Jupiter Staked SOL

Jupiter Staked SOL  ether.fi Staked ETH

ether.fi Staked ETH  Starknet

Starknet  Helium

Helium  JasmyCoin

JasmyCoin  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  eCash

eCash  Mog Coin

Mog Coin  Tokenize Xchange

Tokenize Xchange  Akash Network

Akash Network  NEO

NEO  cat in a dogs world

cat in a dogs world  AIOZ Network

AIOZ Network  Aerodrome Finance

Aerodrome Finance  Axie Infinity

Axie Infinity  dYdX

dYdX  Core

Core  Kaia

Kaia  MultiversX

MultiversX  NEXO

NEXO  The Sandbox

The Sandbox  ApeCoin

ApeCoin  Pendle

Pendle  Binance-Peg Dogecoin

Binance-Peg Dogecoin  USDD

USDD  Binance Staked SOL

Binance Staked SOL  Mina Protocol

Mina Protocol  ORDI

ORDI  Neiro

Neiro  Decentraland

Decentraland  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Notcoin

Notcoin  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Tether Gold

Tether Gold  Gnosis

Gnosis  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Chiliz

Chiliz  Zcash

Zcash  BOOK OF MEME

BOOK OF MEME  Bitcoin Gold

Bitcoin Gold  Arkham

Arkham  Wormhole

Wormhole  Ethereum Name Service

Ethereum Name Service  IOTA

IOTA  Nervos Network

Nervos Network  Axelar

Axelar  Terra Luna Classic

Terra Luna Classic  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  SuperVerse

SuperVerse  dYdX

dYdX  Virtuals Protocol

Virtuals Protocol  Synthetix Network

Synthetix Network  Beldex

Beldex  PayPal USD

PayPal USD  Ether.fi Staked BTC

Ether.fi Staked BTC  PancakeSwap

PancakeSwap  PAX Gold

PAX Gold  Turbo

Turbo  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Oasis

Oasis  Grass

Grass  CorgiAI

CorgiAI  Super OETH

Super OETH  Safe

Safe  Zerebro

Zerebro  Ronin

Ronin  TrueUSD

TrueUSD  ZKsync

ZKsync  tBTC

tBTC  Kava

Kava  Blur

Blur  GMT

GMT  SPX6900

SPX6900  SATS (Ordinals)

SATS (Ordinals)  DeXe

DeXe  Compound

Compound  Fwog

Fwog  APENFT

APENFT  Astar

Astar  Curve DAO

Curve DAO  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Act I The AI Prophecy

Act I The AI Prophecy  Moo Deng

Moo Deng  Theta Fuel

Theta Fuel  Ondo US Dollar Yield

Ondo US Dollar Yield  PepeCoin

PepeCoin  Eigenlayer

Eigenlayer  Bridged USDC (Polygon PoS Bridge)

Bridged USDC (Polygon PoS Bridge)  1inch

1inch  QuantixAI

QuantixAI  Swell Ethereum

Swell Ethereum  Usual USD

Usual USD  L2 Standard Bridged WETH (Blast)

L2 Standard Bridged WETH (Blast)  WEMIX

WEMIX  Hashnote USYC

Hashnote USYC  WOO

WOO  Stader ETHx

Stader ETHx  Reserve Rights

Reserve Rights  Echelon Prime

Echelon Prime  cWBTC

cWBTC  Memecoin

Memecoin  Trust Wallet

Trust Wallet  Zilliqa

Zilliqa  LayerZero

LayerZero  Gigachad

Gigachad  Jito

Jito  Polygon Bridged WBTC (Polygon POS)

Polygon Bridged WBTC (Polygon POS)  Binance-Peg BUSD

Binance-Peg BUSD  Celo

Celo  Holo

Holo  Polymesh

Polymesh  Osmosis

Osmosis  Livepeer

Livepeer  Amp

Amp  EthereumPoW

EthereumPoW  OriginTrail

OriginTrail  pumpBTC

pumpBTC  Fartcoin

Fartcoin  0x Protocol

0x Protocol  Chill Guy

Chill Guy  PONKE

PONKE  Golem

Golem  Drift Protocol

Drift Protocol  Baby Doge Coin

Baby Doge Coin  Liquid Staked ETH

Liquid Staked ETH  Dash

Dash  Non-Playable Coin

Non-Playable Coin  Siacoin

Siacoin  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Verus

Verus  Enjin Coin

Enjin Coin  Qtum

Qtum  Olympus

Olympus  JUST

JUST  Ankr Network

Ankr Network  Creditcoin

Creditcoin  MimbleWimbleCoin

MimbleWimbleCoin  Gas

Gas  Kusama

Kusama  Ravencoin

Ravencoin  Tribe

Tribe  Dymension

Dymension  SafePal

SafePal  Apu Apustaja

Apu Apustaja  Ether.fi

Ether.fi  Dogs

Dogs  Basic Attention

Basic Attention  Degen (Base)

Degen (Base)  ai16z

ai16z  Solayer Staked SOL

Solayer Staked SOL  aelf

aelf  Mantle Restaked ETH

Mantle Restaked ETH  ConstitutionDAO

ConstitutionDAO  Simon's Cat

Simon's Cat  Illuvium

Illuvium  Aevo

Aevo  Amnis Aptos

Amnis Aptos  CHEX Token

CHEX Token  Manta Network

Manta Network  Metaplex

Metaplex  Mask Network

Mask Network  MX

MX  GMX

GMX  Terra

Terra  Metis

Metis  PUPS•WORLD•PEACE

PUPS•WORLD•PEACE  Bridged Ether (StarkGate)

Bridged Ether (StarkGate)  io.net

io.net  We Love Tits

We Love Tits  Threshold Network

Threshold Network  Nosana

Nosana  CoinEx

CoinEx  Department Of Government Efficiency

Department Of Government Efficiency  Ultima

Ultima  SKALE

SKALE  AltLayer

AltLayer  Nexus Mutual

Nexus Mutual  Quorium

Quorium  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Aethir

Aethir  Banana Gun

Banana Gun  ANDY ETH

ANDY ETH  VVS Finance

VVS Finance  Hamster Kombat

Hamster Kombat  Galxe

Galxe  Decred

Decred  Bitkub Coin

Bitkub Coin  Telcoin

Telcoin  Solar

Solar  Wrapped Ether (Mantle Bridge)

Wrapped Ether (Mantle Bridge)  Delysium

Delysium  Lorenzo stBTC

Lorenzo stBTC  Loopring

Loopring  Gravity

Gravity  yearn.finance

yearn.finance  SwissBorg

SwissBorg  Slerf

Slerf  UMA

UMA  Avail

Avail  aBTC

aBTC  Chia

Chia  HarryPotterObamaSonic10Inu (ETH)

HarryPotterObamaSonic10Inu (ETH)  OUSG

OUSG  Flux

Flux  API3

API3  Ontology

Ontology  Convex Finance

Convex Finance  Rocket Pool

Rocket Pool  Osaka Protocol

Osaka Protocol  Zignaly

Zignaly  Sun Token

Sun Token  Kadena

Kadena  Blast

Blast  USDa

USDa  Mythos

Mythos  Treehouse ETH

Treehouse ETH  SingularityNET

SingularityNET  Centrifuge

Centrifuge  NEM

NEM  Metars Genesis

Metars Genesis  Rollbit Coin

Rollbit Coin  DigiByte

DigiByte  Cetus Protocol

Cetus Protocol  Luce

Luce  cETH

cETH  SPACE ID

SPACE ID  usdx.money USDX

usdx.money USDX  Band Protocol

Band Protocol  Yield Guild Games

Yield Guild Games  Saga

Saga  Constellation

Constellation  Orca

Orca  Audius

Audius  Hivemapper

Hivemapper  Harmony

Harmony  Qubic

Qubic  Casper Network

Casper Network  Clearpool

Clearpool  COTI

COTI  GHO

GHO  Chromia

Chromia  Comedian

Comedian  ETHPlus

ETHPlus  Big Time

Big Time  Renzo Restaked LST

Renzo Restaked LST  Gomining Token

Gomining Token  michi

michi  Kamino

Kamino  Alchemix USD

Alchemix USD  Across Protocol

Across Protocol  Lisk

Lisk  Maple

Maple  Arbitrum Bridged USDC (Arbitrum)

Arbitrum Bridged USDC (Arbitrum)  sudeng

sudeng  H2O Dao

H2O Dao  OKT Chain

OKT Chain  Moonwell

Moonwell  Cheems Token

Cheems Token  Bybit Staked SOL

Bybit Staked SOL  Elixir deUSD

Elixir deUSD  Waves

Waves  Bitcoin Wizards

Bitcoin Wizards  Blox

Blox  Sundog

Sundog  Mister Miggles

Mister Miggles  Smooth Love Potion

Smooth Love Potion  Merlin Chain

Merlin Chain  WAX

WAX  Sushi

Sushi  StakeWise Staked ETH

StakeWise Staked ETH  IQ

IQ  Instadapp

Instadapp  Status

Status  PAAL AI

PAAL AI  Ontology Gas

Ontology Gas  Balancer

Balancer  Ocean Protocol

Ocean Protocol  Marlin

Marlin  Purr

Purr  JOE

JOE  Spectral

Spectral  Songbird

Songbird  Origin Ether

Origin Ether  STASIS EURO

STASIS EURO  Powerledger

Powerledger  BILLION•DOLLAR•CAT (Runes)

BILLION•DOLLAR•CAT (Runes)  IOST

IOST  Cronos Bridged USDC (Cronos)

Cronos Bridged USDC (Cronos)  MUMU THE BULL

MUMU THE BULL  Horizen

Horizen  Alephium

Alephium  DeepBook

DeepBook  MMX

MMX  Nano

Nano  L2 Standard Bridged WETH (Optimism)

L2 Standard Bridged WETH (Optimism)  Open Campus

Open Campus  Orbs

Orbs  Ampleforth

Ampleforth  BORA

BORA  CARV

CARV  MVL

MVL  RETARDIO

RETARDIO  Kinesis Gold

Kinesis Gold  Bridged Wrapped stETH (Gnosis)

Bridged Wrapped stETH (Gnosis)  SSV Network

SSV Network  iExec RLC

iExec RLC  LandWolf

LandWolf  Cartesi

Cartesi  Ozone Chain

Ozone Chain  Oraichain

Oraichain  TerraClassicUSD

TerraClassicUSD  Autonolas

Autonolas  Goldfinch

Goldfinch  Coin98

Coin98  Pundi X

Pundi X  SmarDex

SmarDex  Kinesis Silver

Kinesis Silver  Neutron

Neutron  Catizen

Catizen  Arcblock

Arcblock  Liquity

Liquity  Venus

Venus  Numeraire

Numeraire  TruFin Staked APT

TruFin Staked APT  MOO DENG

MOO DENG  Spell

Spell  Zentry

Zentry  BounceBit

BounceBit  Sologenic

Sologenic  Rifampicin

Rifampicin  Scroll

Scroll  Myro

Myro  Optimism Bridged WBTC (Optimism)

Optimism Bridged WBTC (Optimism)  Toshi

Toshi  RSK Infrastructure Framework

RSK Infrastructure Framework  Humans.ai

Humans.ai  Tokenlon

Tokenlon  Universal ETH

Universal ETH  RabBitcoin

RabBitcoin  Wen

Wen  BasedAI

BasedAI  Pax Dollar

Pax Dollar  Ergo

Ergo  Civic

Civic  XYO Network

XYO Network  Magic

Magic  My Neighbor Alice

My Neighbor Alice  CYBER

CYBER  Escoin

Escoin  BONGO CAT

BONGO CAT  Artificial Liquid Intelligence

Artificial Liquid Intelligence  Ignition FBTC

Ignition FBTC  Coq Inu

Coq Inu  Satoshi Airline

Satoshi Airline  UXD Protocol

UXD Protocol  Alchemy Pay

Alchemy Pay  VitaDAO

VitaDAO  Hive

Hive  MANEKI

MANEKI  Solana Name Service

Solana Name Service  ARK

ARK  Paycoin

Paycoin  NKYC Token

NKYC Token  Adventure Gold

Adventure Gold  Function X

Function X  Dent

Dent  Clover Finance

Clover Finance  The Doge NFT

The Doge NFT  Dogelon Mars

Dogelon Mars